Scalping is a well known, speedy exchanging procedure utilized by numerous dealers to profit by little cost developments in exceptionally fluid business sectors. A procedure requires accuracy, speed, and a capacity to settle on fast choices. In this article, we will investigate the scalping method exhaustively, examining its essentials, the devices required, advantages, difficulties, and how you can carry out this procedure actually.

What is Scalping in Exchanging?

Scalping is an exchanging system pointed toward creating little gains from minor cost changes in a short measure of time. A “hawker” looks to benefit from market failures or extremely transient cost developments, normally executing various exchanges inside a solitary day. The thought behind scalping is to catch little cost changes, which might appear to be immaterial all alone, yet when intensified over various exchanges, can bring about significant benefits.

Key Attributes of Scalping:

Time period: Scalping includes executing exchanges exceptionally short time periods, generally minutes or even seconds. Exchanges can endure anyplace from a couple of moments to a few minutes, contingent upon economic situations.

Exchange Recurrence: Hawkers regularly execute a high volume of exchanges inside a solitary day, in some cases handfuls or even many exchanges. Each exchange tries to catch a little benefit.

Little Overall revenues: In contrast to other exchanging systems that go for the gold swings, scalping centers around catching little cost changes. While individual benefits per exchange are insignificant, the total benefits from various exchanges can be critical.

High Influence: Since the benefits from each exchange are little, hawkers frequently use influence to enhance their profits. Be that as it may, this additionally expands the gamble related with scalping.

Devices and Pointers Utilized in Scalping

For a hawker to find success, they need to utilize the right devices and pointers to settle on quick and informed choices. Here are probably the most regularly involved devices in scalping:

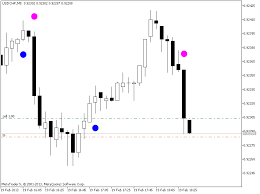

Graphing Programming: Hawkers depend on outlining programming that gives continuous, precise cost information. These stages offer high level elements, for example, tick graphs, live cost takes care of, and different drawing instruments that assist with recognizing transient cost patterns.

Specialized Markers: Hawkers frequently utilize specialized pointers to distinguish section and leave focuses. Probably the most usually utilized pointers include:

Moving Midpoints (MAs): Momentary moving midpoints (e.g., 5 or 10-period Mama) assist hawkers with distinguishing the course of the market and potential section focuses.

Relative Strength List (RSI): The RSI is utilized to decide overbought or oversold conditions, which can show a likely inversion.

Stochastic Oscillator: This device assists brokers with spotting potential cost defining moments by contrasting the ongoing cost with a scope of costs over a predefined period.

Level 2 Information: This gives definite data on market profundity, including the quantity of trade orders at different cost levels. Hawkers utilize this data to measure the liquidity and possible bearing of the market.

Quick Execution Stage: Hawkers need to act rapidly, so they normally use exchanging stages that offer super quick request execution to keep away from slippage and guarantee they can enter and leave positions at the ideal costs.

Sorts of Scalping

While all scalping procedures center around little benefits from fast exchanges, there are various varieties in how merchants approach it:

Market Making: In this methodology, hawkers give liquidity to the market by at the same time submitting trade requests at various cost levels. They expect to benefit from the distinction between the bid and ask costs, known as the spread.

Request Stream Scalping: This strategy includes dissecting the progression of market requests to recognize transient cost developments. Hawkers utilizing this approach search for enormous trade orders that might set off a cost move.

Force Scalping: Merchants utilizing this procedure benefit from short eruptions of energy, regularly in unpredictable business sectors. They enter exchanges when a solid cost move is distinguished and exit when energy starts to blur.

Advantages of Scalping

Decreased Openness to Market Hazard: Since hawkers stand firm on footings for a brief time frame, they are less presented to showcase risk contrasted with other exchanging procedures that include standing firm on footholds for longer periods.

High Likelihood of Progress: The little, speedy moves designated by hawkers are more straightforward to foresee and exchange than bigger, longer-term market patterns, making it feasible for brokers to make a higher progress rate with restrained execution.

Benefit in Both Bull and Bear Markets: Scalping can be productive in both rising and falling business sectors, as long as the market is fluid and has little cost developments. Hawkers don’t depend available’s bearing but instead on its instability.

Less Weight on Profound Independent direction: Hawkers go with fast choices and by and large stay away from the drawn out close to home ups and downs that can influence longer-term dealers. Since exchanges are opened and shut quickly, there is less opportunity to re-think choices.

Difficulties of Scalping

High Exchange Expenses: Since hawkers make numerous exchanges, exchange costs, including commissions and spreads, can rapidly eat into benefits. Hawkers should pick agents with low charges to make the methodology suitable.

Time and Concentration: Scalping requires serious focus and speedy independent direction. Dealers should screen the market continually, which can be tedious and intellectually debilitating.

Influence Dangers: Numerous hawkers use influence to enhance little benefits. Notwithstanding, the utilization of influence likewise builds the potential for huge misfortunes, particularly when economic situations don’t line up with the exchange.

Slippage: In quick business sectors, the cost you hope to enter or exit at may not be the cost you really get. This can bring about slippage, which can adversely influence scalping benefit.

Tips for Effective Scalping

Begin with a Strong Arrangement: Like any exchanging system, scalping requires a thoroughly examined plan. Decide the time spans you’ll zero in on, the resources you’ll exchange, and your gamble the executives strategies before you start.

Practice with a Demo Record: Scalping can be testing, so it’s prudent to rehearse with a demo account prior to exchanging with genuine cash. This will assist you with becoming familiar with the high speed nature of scalping and adjust your procedure.

Center around Fluid Business sectors: Scalping works best in profoundly fluid business sectors, where little value developments can be effortlessly taken advantage of. Pick resources with high exchanging volume to guarantee you can enter and leave positions rapidly.

Execute Chance Administration: Even with little exchanges, risk the board is pivotal. Use stop-misfortune orders to safeguard yourself from significant misfortunes and never risk a lot of your exchanging capital on a solitary exchange.

End

Scalping is an exchanging system that can be exceptionally remunerating for dealers who have the persistence, discipline, and instruments to effectively carry out it. While the methodology offers various benefits, for example, easy gains and decreased market openness, it’s not without its difficulties, including high exchange costs and the psychological requests of consistent market checking. Merchants who can adjust to the speedy idea of scalping and carry out powerful gamble the board methodologies might possibly make progress with this strategy. Whether you are new to exchanging or hoping to refine your abilities, understanding scalping exhaustively is fundamental for anyone with any interest in chasing after this strategy for exchanging.