Energy exchanging is a famous and exceptionally powerful system that depends on the idea of “purchasing high and selling higher.” It centers around stocks or resources that are moving essentially in one course, either up or descending, in light of the conviction that these patterns will go on for a period. In this article, we’ll plunge profound into energy exchanging, its fundamental standards, techniques, and tips to amplify its viability in the always developing business sectors.

What is Energy Exchanging?

Energy exchanging is a procedure where brokers look to distinguish protections that are moving firmly in a specific heading. The thought is that resources that have serious areas of strength for shown moves will keep on moving in a similar heading for some time. These patterns can be distinguished through specialized investigation, and brokers use force pointers to assist with affirming the heading and strength of these moves.

The idea of force comes from the conviction that “the pattern is your companion.” A stock or resource that has picked up huge speed might go on that way because of different market factors, for example, news, income reports, or more extensive financial movements. Force brokers commonly enter the market right off the bat in a pattern and ride the wave until the energy begins to blur or converse.

Center Standards of Energy Exchanging

Pattern Following: The center rule of force exchanging is distinguishing resources that are as of now moving. Brokers closely follow after the pattern instead of attempting to anticipate inversions. This approach assists them with riding the pattern until indications of debilitating or inversion show up.

Volume Affirmation: Energy merchants frequently search for an expansion in exchanging volume, as this can be an indication that the pattern is reinforcing. High volume demonstrates that more market members are engaged with the cost development, expanding the likelihood that the pattern will proceed.

Timing and Speed: The planning of entering and leaving an exchange is pivotal in energy exchanging. Brokers intend to enter when the pattern is beginning to assemble, and leave when indications of inversion or debilitating force show up. Speed is additionally key; energy brokers frequently profit by transient cost moves, meaning their exchanges can endure anyplace from minutes to days.

Risk The executives: Like any exchanging methodology, powerful gamble the board is fundamental in energy exchanging. Since energy can switch rapidly, brokers frequently use stop-misfortune orders and position estimating to deal with their gamble. This helps limit likely misfortunes in the event that the pattern wavers.

Key Energy Pointers

Energy brokers depend intensely on specialized investigation to recognize potential exchange arrangements. The absolute most famous markers include:

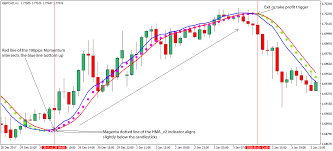

Moving Midpoints: Moving midpoints, particularly the Outstanding Moving Normal (EMA), are frequently used to distinguish the bearing of the pattern. At the point when the cost is over the moving normal, it demonstrates an upturn, and when it is underneath, it flags a downtrend. The hybrid of present moment and long haul moving midpoints can likewise flag changes in force.

Relative Strength List (RSI): RSI is a famous energy oscillator that assists merchants with estimating the strength of a pattern. It goes from 0 to 100 and is considered overbought when over 70 and oversold when under 30. RSI can assist with distinguishing potential inversion focuses in a moving business sector.

Moving Normal Intermingling Dissimilarity (MACD): The MACD is a pattern following energy pointer that shows the connection between two moving midpoints (generally the 12-day and 26-day EMAs). The MACD line crossing above or beneath the sign line can give experiences into the strength and heading of the pattern.

Energy Pointer: The Force marker is a basic device that actions the pace of progress of a resource’s cost. A rising force pointer demonstrates a speeding up pattern, while a falling marker proposes a debilitating pattern. Merchants utilize this to measure the potential for continuation or inversion.

Energy Exchanging Techniques

Energy exchanging methodologies change contingent upon the merchant’s gamble resistance and time span. Here are a few well known systems utilized by energy merchants:

Breakout Technique: This system includes entering an exchange when a resource gets through a vital help or obstruction level areas of strength for with. A breakout commonly flags the beginning of a recent fad, and brokers mean to get the move right on time before the pattern picks up max throttle. A breakout is frequently affirmed with a flood in volume.

Pullback System: Merchants utilizing the pullback methodology enter an exchange when a resource in an upturn briefly remembers (pulls back) prior to proceeding with its vertical development. Pullbacks offer a lower-risk section point and should be visible as a “purchase the plunge” opportunity inside a solid pattern.

Hole Exchanging: Holes in cost can major areas of strength for demonstrate. A hole happens while the initial cost of a security is fundamentally not quite the same as the earlier day’s nearby, frequently because of information or profit reports. Dealers search for continuation designs after the hole to enter exchanges the heading of the energy.

Pattern Following: This is the most clear energy technique. Dealers utilizing this strategy will trust that a reasonable pattern will create and afterward enter the market toward that pattern. They regularly utilize a blend of specialized markers, such as moving midpoints or MACD, to affirm the strength and supportability of the pattern.

Benefits of Force Exchanging

Potential for Significant yields: Energy exchanging permits merchants to gain by significant cost developments. Since energy can go on for broadened periods, dealers have the potential for significant yields in a moderately brief time frame.

Clear Section and Leave Signs: With force markers and specialized examination, dealers can lay out clear passage and leave focuses. This diminishes the equivocalness engaged with exchanging, considering a more organized approach.

Appeal to Dynamic Brokers: Energy exchanging is appropriate to dynamic merchants who appreciate quick moving independent direction. Since energy exchanges normally last from minutes to days, it gives sufficient chances to benefit from transient cost vacillations.

Dangers and Difficulties in Energy Exchanging

While energy exchanging offers incredible potential, it likewise accompanies critical dangers. These include:

Inversion Hazard: Energy can rapidly turn around, prompting abrupt misfortunes. On the off chance that a merchant neglects to perceive an inversion or exits past the point of no return, they might experience critical drawdowns.

Overtrading: The quick idea of energy exchanging can entice brokers to overtrade or pursue each transient pattern. This can prompt pointless misfortunes and increment exchange costs.

Misleading Breakouts: Once in a while, value developments can seem to break key levels however immediately converse. Merchants who enter exchanges in view of bogus breakouts might encounter misfortunes as the pattern neglects to appear.

Market Clamor: In unpredictable business sectors, force pointers can give misleading signs, driving brokers to take untimely actions. Brokers should practice alert and try not to follow up on each little change in cost.

End

Energy exchanging can be a profoundly productive technique when executed with discipline and legitimate gamble the board. By grasping the key standards, utilizing the right specialized pointers, and utilizing the suitable procedures, merchants can benefit from market patterns. Notwithstanding, it’s vital for stay cautious and be ready for market inversions, which can happen whenever. Assuming you’re new to energy exchanging, begin little, test various procedures, and consistently focus on risk the board to safeguard your capital in the quick universe of force exchanging.